Why More Families Are Accessing Family Office Services Sooner

The internet has fundamentally changed how people learn about wealth management. YouTube channels explain complex investment strategies, podcasts dissect family office structures and online communities share real experiences with alternative assets. Private Market investment platforms are continuously lowering the minimum investment size, making it more accessible for “smaller” portfolios. Platforms like Reddit host detailed discussions about QSBS optimization, while LinkedIn features case studies on cross-border tax planning.

Clients now educate themselves through multiple sources and access the same educational content that was once exclusive to institutional investors.

This creates a new reality: clients with €2 million understand portfolio construction better than €20 million clients did a decade ago. They expect transparency, real-time access and personalized insights regardless of their account size.

The New Thresholds: From €1M to €10M

Traditionally, wealth managers work with clients who have €1-5 million in investable assets. Multi-family offices typically require €10 million, especially for complex structures or cross-border needs.

But some providers now offer family office experiences starting from €1,000,000, using automation to scale down services that were once exclusive to the ultra-wealthy.

The real threshold isn’t asset size anymore-it’s complexity. A tech entrepreneur with €5million and more, spread across stock options, real estate and start-up investments, needs more sophisticated reporting than someone with €10 million in public equity.

How Technology Makes This Possible

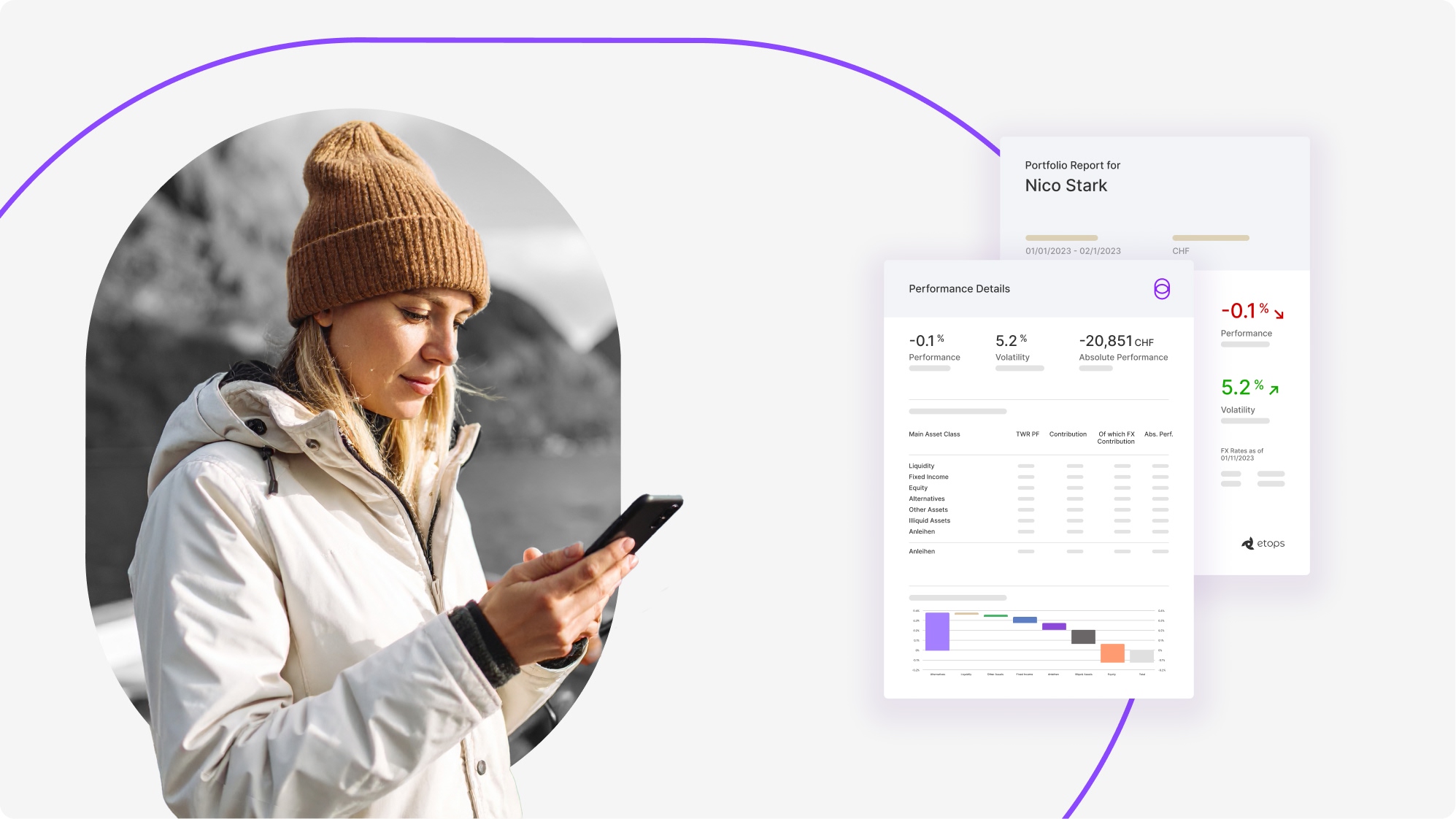

Modern platforms can consolidate data from multiple banks, custodians and alternative sources. They integrate illiquid assets into unified overviews and generate compliant reports through simple interfaces.

What once required dedicated teams and heavy infrastructure, now runs on scalable technology. The same systems that serve €100 million families can handle dozens of smaller clients efficiently.

What This Means for Wealth Management

This opens an entirely new market. Wealth managers who adapt can now serve clients they previously couldn’t touch:

Entrepreneurs with complex equity structures, professionals with cross-border assets and families needing governance frameworks without ultra-high net worth. These clients are also increasingly turning to private market investments, such as private equity and real estate, to capture liquidity premiums and access opportunities beyond public markets. While illiquid assets offer potential for higher returns, they require longer investment horizons and cashflow planning.

Wealth managers who offer consolidated reporting and analytics across both liquid and illiquid assets empower families to make informed decisions, manage risk effectively and build resilient portfolios tailored to their unique goals.

The addressable market has just expanded dramatically. Instead of competing for a limited pool of UHN families, managers can build sustainable businesses serving the much larger population of sophisticated clients with €1M to €10M in assets.

This isn’t about informed versus uninformed clients. It’s about access to a market that was previously locked out by operational constraints rather than actual need.

The real opportunity lies with those who understand that what matters most today isn’t how much wealth a client has, but how complex their situation is.

Firms that start building this reality now will be best positioned to meet the needs of tomorrow’s clients.