The Problem with Disconnected Tools

Generic portfolio struggles with the realities of family office operations. Multiple custodians, layered structures, and nuanced mandates quickly expose the limits of off-the-shelf solutions. Add multi-currency portfolios and compliance requirements, and the risk of errors, and inefficiencies, skyrockets.

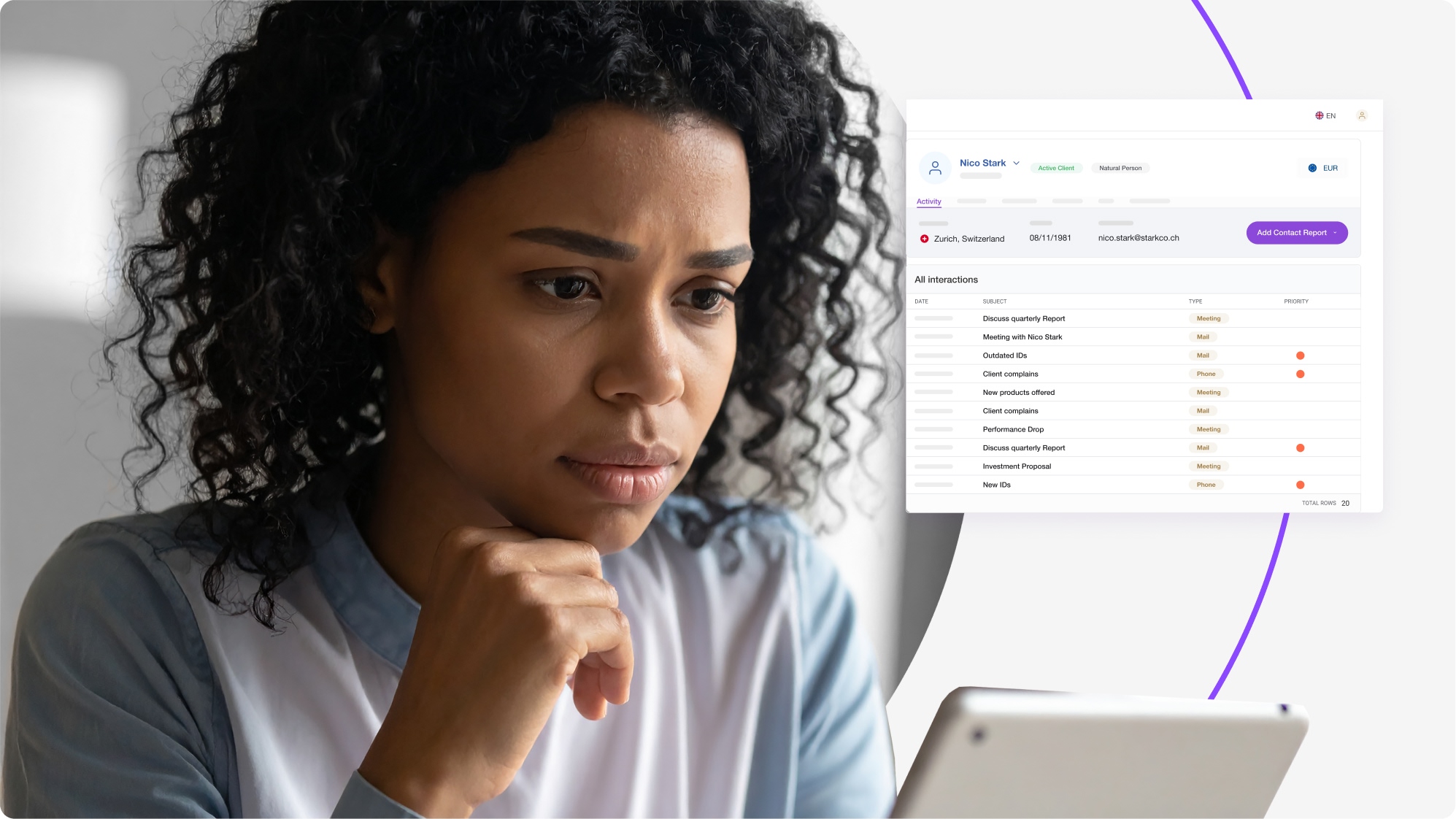

Why a Unified View Matters

Family offices need more than basic reporting; they need a single source of truth. A unified platform that consolidates all assets, across entities and currencies, enables:

- Real-time portfolio visibility across bankable and non-bankable assets.

- Integrated compliance workflows for KYC, AML, and investment restrictions.

- Dynamic reporting and analytics for informed decision-making.

When all data originates from a single source, reporting becomes faster, cleaner, and more transparent.

Beyond Numbers: Insight and Control

Family offices need more than compliance, they need insight. A holistic view allows look-through reporting across complex structures, so you can drill down from consolidated performance to individual holdings. It supports scenario analysis, risk monitoring and tailored reporting for family members and advisors, all from one platform.

Scaling for the Future

As family offices grow, so does complexity. Adding new entities or asset classes shouldn’t mean juggling more systems. Scalable platforms integrate with portals and APIs, connect to analytics tools, and adapt as your needs evolve.

The goal: a single source of truth that underpins decision-making and supports growth.

This is where etops Wealth Discovery adds value, it consolidates portfolios across custodians, supports multi-currency reporting, and integrates compliance workflows, giving family offices the clarity and agility they need to manage wealth across generations.

Looking Ahead

In an era of global wealth and intricate structures, family offices can’t afford fragmented tools. A unified platform isn’t a luxury, it’s a necessity for transparency, control and long-term success.