The Challenges IFAs Face Today

- Digital expectations: Clients want 24/7 access, interactive reporting, and mobile-first experiences. Quarterly PDFs no longer cut it.

- Regulatory complexity: Compliance with MiFID II, FIDLEG, and SFDR is now a differentiator, not just a requirement.

- Operational strain: Manual processes and outdated systems slow growth and increase risk.

How SaaS Helps IFAs Compete

A modern SaaS platform transforms these challenges into opportunities:

- Streamlined Onboarding and Workflows

Digital tools replace paper-heavy processes, making client onboarding faster and more efficient. Features like automated KYC checks and e-signatures reduce friction and improve the client experience.

- Compliance Built In

Automated monitoring and documentation aligned to MiFID II, WpHG, SFDR, and FIDLEG help IFAs stay ahead of regulatory change without adding headcount.

- Scalable Digital Advice

Integrated robo-advisory capabilities generate suitability statements and cost disclosures automatically, ensuring consistency and audit readiness.

- A Modern Client Experience

Secure portals give clients real-time portfolio views, goal tracking, and personalized insights, accessible on web and mobile.

- Lower IT Burden, Greater Flexibility

Cloud-native architecture and open APIs allow IFAs to scale without heavy infrastructure or disruptive upgrades.

Why Etops?

Etops is more than a technology provider, it’s a partner for IFAs navigating the complexity of modern wealth management. Our products are designed specifically for the European advisory landscape, combining regulatory expertise, operational efficiency, and client experience innovation in one integrated solution.

Regulatory Confidence

Compliance is at the heart of our platform. Etops supports MiFID II, WpHG, SFDR, and FIDLEG, ensuring IFAs can meet evolving requirements without adding manual workload. Automated monitoring, real-time alerts, and audit-ready documentation reduce risk and free up time for client-facing activities.

Operational Efficiency

Our tools replace fragmented, manual processes with streamlined digital workflows. From onboarding to portfolio reporting, automation reduces administrative overhead and minimizes errors, allowing advisors to focus on growing assets under management.

Client Experience That Builds Loyalty

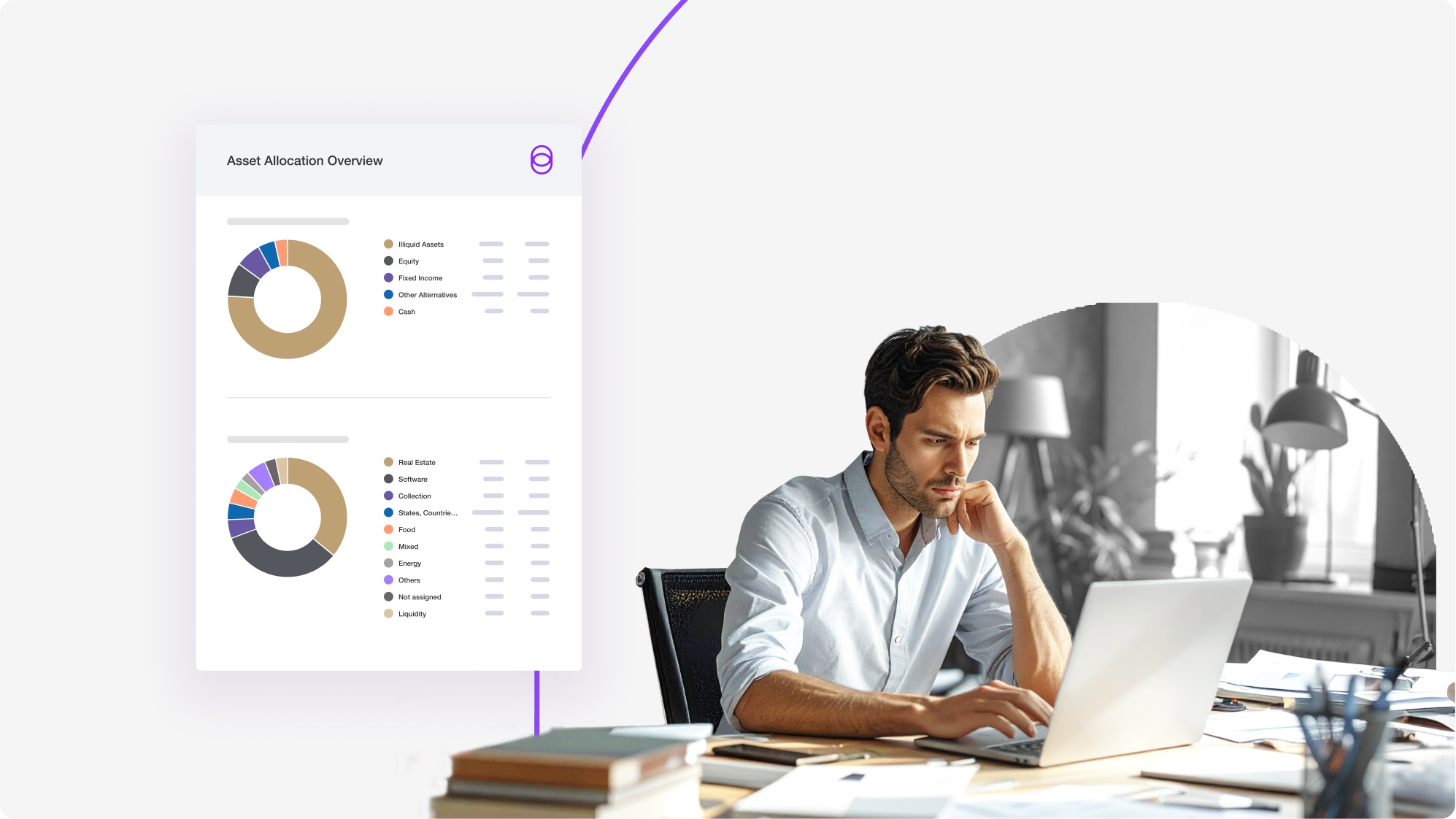

Today’s investors expect transparency and immediacy. Etops delivers secure, interactive portals with real-time portfolio views, goal tracking, and personalized insights.

This isn’t just a feature; it’s a competitive advantage in an experience-driven market.

Scalability and Flexibility

Built on a cloud-native architecture, Etops scales as your business grows, without the cost and complexity of legacy systems. Our open API ecosystem makes integration with custodians, data providers, and third-party tools seamless, so you can build the tech stack that fits your strategy.

Proven Expertise in the IFA Segment

We have a strong footprint in Germany and Switzerland and are expanding across Europe. Our solutions are shaped by deep knowledge of the IFA business model and the regulatory frameworks that govern it.

The Bottom Line

For IFAs, digital transformation is no longer optional, it’s essential.

Software platforms like Etops turn operational complexity into competitive advantage, helping advisors deliver the experience clients expect while staying compliant and efficient.

Ready to see what’s possible?

Discover how Etops helps Independent Financial Advisors simplify compliance, scale operations, and deliver superior client experiences.