A Complex Landscape, A Singular Opportunity

The European market faces growing complexity: cross-border regulations, a booming alternative assets scene, and the largest intergenerational wealth transfer in history. Family offices, private banks, and institutional investors are under pressure to deliver faster, more transparent service. In this environment, legacy workflows and siloed systems fall short.

What’s needed is unified, hyper-flexible technology that can keep pace with evolving client expectations.

Unified Data, Unmatched Insight

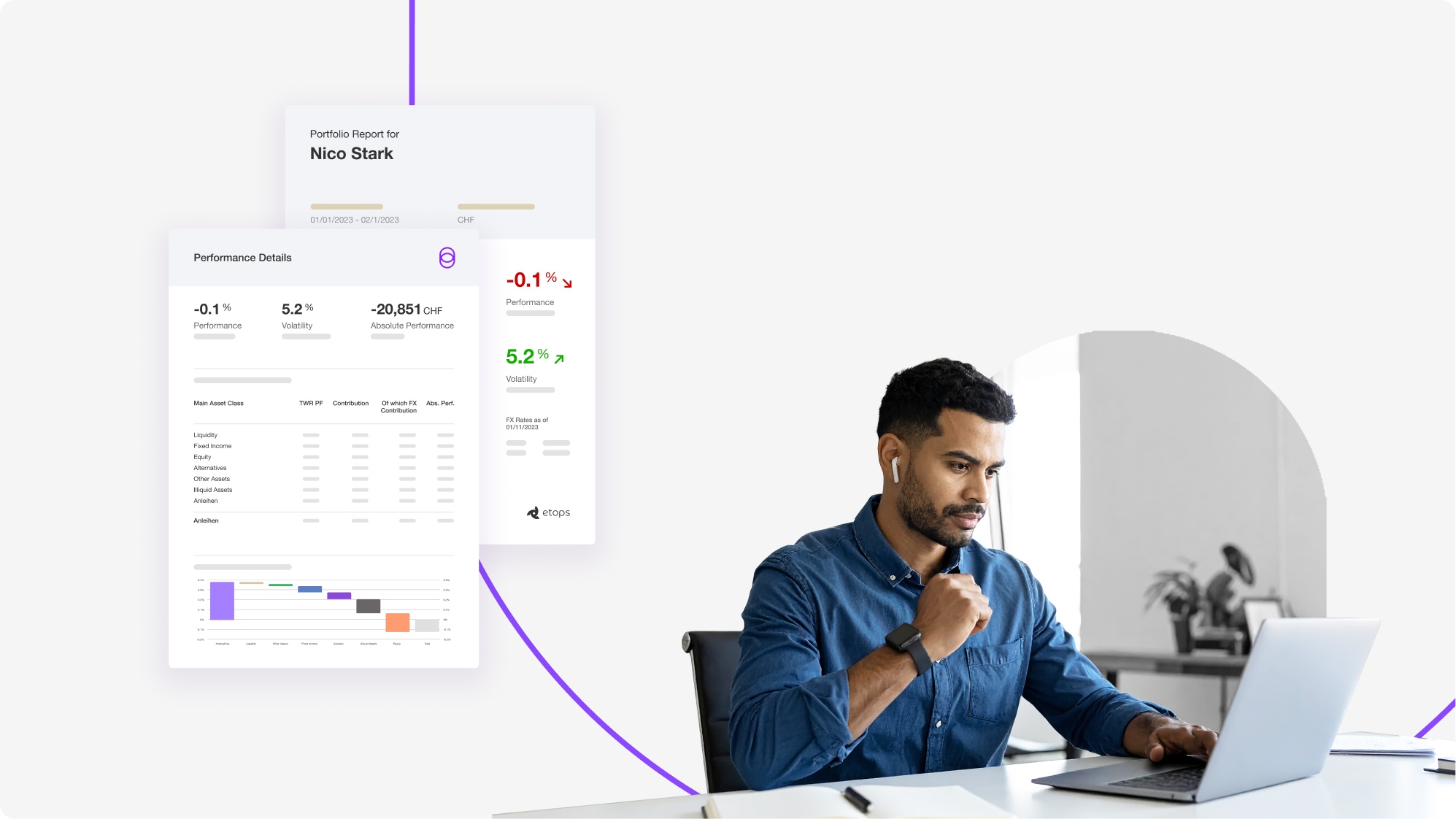

Across Europe, investment professionals increasingly expect real-time, holistic portfolio views. At Etops, we aggregate and normalise data from all sources, including illiquid assets and non-traditional holdings. This enables multi-custodian, multi-asset oversight, dynamic scenario modelling, and fully customised reporting tailored to each stakeholder’s perspective.

As wealth structures grow more sophisticated, integrated and accessible data becomes the foundation for smarter client outcomes. It’s not just about operational efficiency, it’s about enabling better decisions.

Speed and Flexibility: The Agile Advantage

The defining feature of this new era isn’t simply more technology, it’s a new tempo. Whether onboarding a new family office or integrating ESG analytics, firms need solutions that adapt in weeks, not quarters.

Etops delivers on this need with modular, API-first platforms that deploy rapidly and evolve with the market. Free from monolithic architectures, European asset managers gain the confidence to innovate quickly and decisively.

Embedded Intelligence: AI and Next-Gen Analytics

Artificial intelligence has become a core component of modern asset management. Platforms like Etops support dynamic risk modelling, predictive monitoring, and automated compliance, allowing portfolio managers to act proactively. These capabilities enhance alpha generation, improve operational efficiency, and enable personalised, always-on advisory.

As regulation tightens, especially around complex products and cross-border activity integrated AI also helps reduce compliance burdens, making it a strategic asset rather than a cost centre.

Sustainable, Secure, and Client-Centric

Sustainability is now a business imperative in Europe. Clients demand investments that reflect their values and meet regulatory standards. Etops supports this shift with built, in ESG data aggregation and reporting, making responsible investing scalable and efficient.

Security is equally critical. Our unified cloud platform offers bank-grade encryption, rigorous access controls, and full auditability, ensuring that client data and assets remain protected in an increasingly volatile world.

From Platform to Partnership

Technology alone isn’t enough. At Etops, we see ourselves as strategic partners, working closely with clients to co-create solutions tailored to their evolving challenges. In a continent as diverse as Europe, this means supporting local nuances, regulatory regimes, and unique market needs. It’s a commitment to collaboration, not just configuration.

Looking Ahead: Europe’s Asset Management Edge

The wealth management leaders of tomorrow won’t be those with the biggest tech budgets, but those with the most adaptable, future-ready stacks. As echoed by innovators like Etops, Europe’s asset managers are rising to the challenge with technology that unifies, intelligence that empowers, and partnerships that endure.

Now is the time to reimagine how your data, workflows, and client experiences can work for you, not against you.

At Etops, we’re leading the way, because in 2025, clarity and agility are the ultimate competitive edge.

Ready to lead the transformation?

Discover how Etops can help you unify your data, accelerate your workflows, and deliver next-gen client experiences.

Click down below to schedule a tailored demo or strategy session!